There’s been no shortage of criticism of “Helicopter” Ben Bernanke’s aggressive quantitative easing policies. But you have to hand it to the man. He’s nothing if not determined. Against all odds and even the laws of financial physics, he’s accomplished his primary goal—juicing stock prices.

The problem is, as usual, most average investors are behind the curve.

Year-to-date, as the NY Times pointed out Sunday, more than $85 billion has been put into bond mutual funds compared to only $73 billion for stock funds. But buying bonds is not a wise strategy going forward. Thanks to Uncle Ben’s interventions and other factors, stocks are almost surely going to outperform bonds for the next three, five, maybe even ten years.

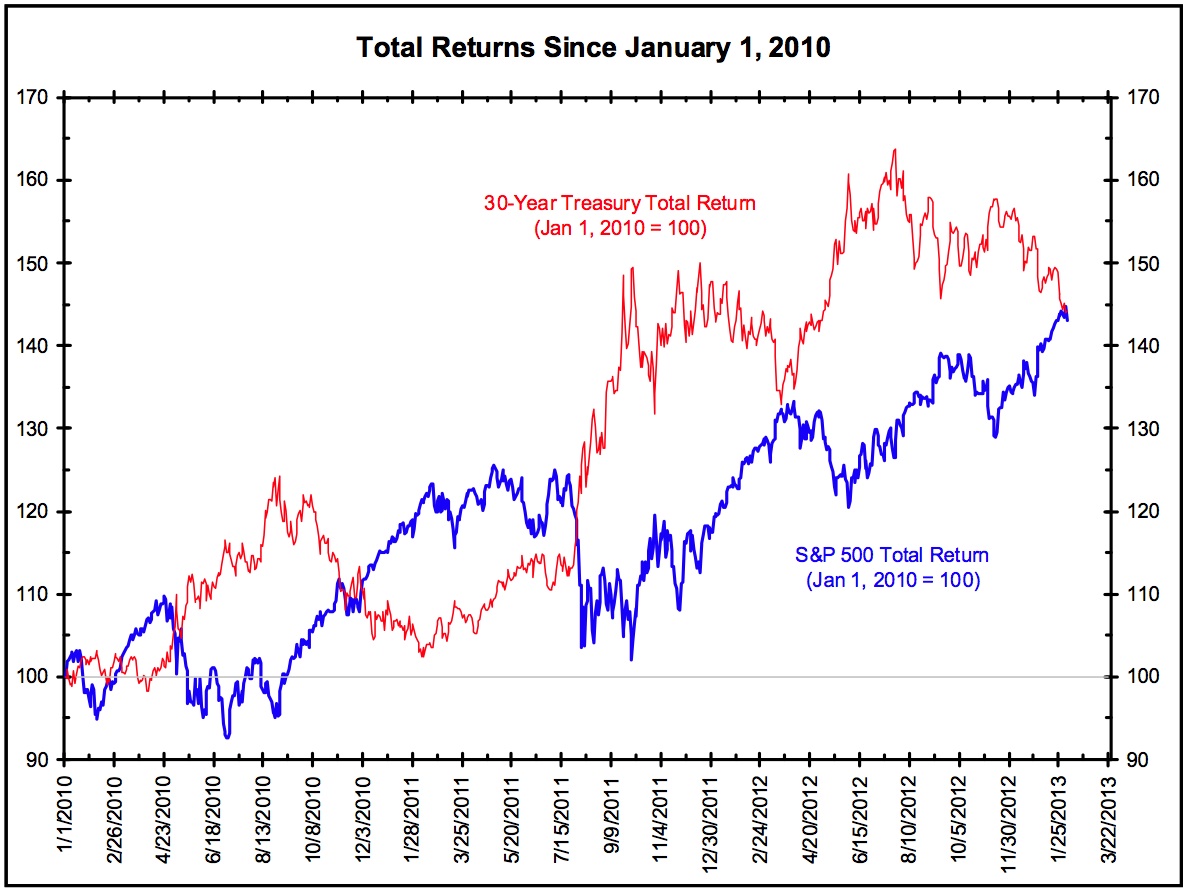

Usually, in an era of lackluster economic growth like we’ve seen around these parts since, well, a long time ago, the bond market thrives while equities languish. And, not surprisingly, fixed income has beaten out stocks in the last decade. But as Barry Ritholtz documented at the time, returns on the S&P caught up with bonds in February—despite the fact that, if anything, the economic outlook had only gotten worse (this was right around the time we were all learning the meaning of the word “sequester”):

Bernanke has pulled off this unprecedented monetary half-gainer by, first, kneecapping interest rates and then repeatedly clubbing them over the head until they went down and stayed down. This has choked the market with liquidity, boosting corporate balance sheets even as the economy has been at a virtual standstill and allowing troubled companies to refinance bad debts. Believe me, I know just how effective Uncle Ben’s magical money printing tour has been. It’s absolutely punished my short portfolio. Dozens of companies I expected to go bankrupt have, instead, revived themselves by refinancing.

Now, Bernanke’s interventions have also lifted bond prices. As I write this, the ten-year Treasury bond is yielding 1.92 percent, while the 30-year is at 3.13 percent. Incredibly, they’re both up from 1.66 and 2.83 percent, respectively, on May 1st. Bond yields simply can’t get much lower than that, meaning prices can’t get much higher. Stocks, on the other hand don’t have this ceiling. And Bernanke can’t keep buying $85 billion worth of bonds a month indefinitely. At some point, he’s going to have to land the helicopter. Meanwhile, despite the best efforts of our political leaders, the economy is likely to get better in the future. That, too, will whip up equities and gag bond prices.

The answer for individual investors is deceptively simple. They should buy into low-cost S&P 500 index funds. (I’ve only been writing this blog for a month or so, and I know I’ve already said this a half dozen times, but I’m going to keep saying it, because it’s true.) It’s not just that bond returns are lagging equities, global economic trends favor the companies in the S&P 500, as well. Roughly forty percent of their profits come in from overseas now. So even if the U.S. continues to limp along under a divided government and know-nothing leadership, our multinationals will find revenues in the world’s fastest-growing economies. And, as the Sunday Times piece points out, as more and more people begin to chase better returns by jumping from bonds to stocks, this Bernanke-fueled bull market for stocks will only run higher.